In my previous article “Mind the Gap”, I highlighted the common pitfalls small business owners face when structuring their income. Let’s now look at the practical impact for sole directors without employees – and why it often makes sense to take a minimum wage salary, even if it means paying some National Insurance.

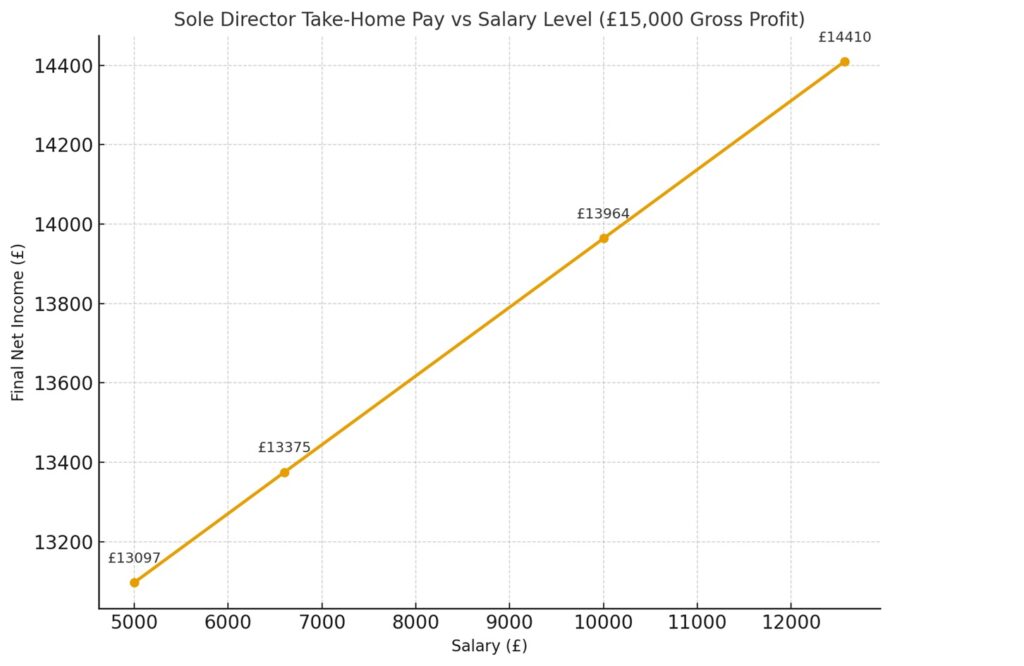

Let’s assume a small limited company with a gross profit of £15,000. The director can choose how much to take as wages versus dividends. Below are four examples showing different salary levels:

| Gross Profit | £15,000 | £15,000 | £15,000 | £15,000 |

|---|---|---|---|---|

| Wages | £5,000 | £6,600 | £10,000 | £12,570 |

| Net Profit | £10,000 | £8,400 | £5,000 | £2,430 |

The split between salary and dividends then affects corporation tax, National Insurance, and personal tax:

| Salary | £5,000 | £6,600 | £10,000 | £12,570 |

|---|---|---|---|---|

| Dividends ( Net Profit- Corporation tax) | £8,100 | £6,804 | £4,050 | £1,968 |

| Employer’s NI | £0 | £240 | £750 | £1,135.50 |

| Corporation Tax | £1,900 | £1,596 | £950 | £461.70 |

| Total “Cost” (NI + CT) | £1,903 | £1,865 | £1,786 | £1,726 |

Now let’s look at the total income received by the director after all taxes:

| Salary + Dividends | £13,100 | £13,404 | £14,050 | £14,538.30 |

| Personal Income Tax | £3 | £29 | £86 | £128 |

| Final Net Income | £13,097 | £13,375 | £13,964 | £14,410 |

At first glance, taking a higher salary seems to give you slightly more income – but here’s the important point:

When you take at least the minimum salary (£12,570), you maximise your tax efficiency.

For sole directors with no employees, the most tax-efficient strategy is still to pay yourself at least the minimum wage (currently £12,570). While paying National Insurance may feel like a cost, it actually secures your benefits record and reduces corporation tax – leaving you with the highest possible take-home pay for the lowest tax outlay.

This is a reminder that sometimes, paying a little tax in the right way is the smartest move.